The transformative potential of artificial intelligence (A.I.) is revolutionizing financial services, yet its integration into client reporting and performance measurement presents unique challenges.

At the recent Performance Measurement Client Reporting (PMCR) 2025 event organized by FTF, a panel discussion moderated by Vinod Jain, from Datos Insights, with industry leaders explored how A.I. adoption varies across organizations and what it means for the future of capital markets.

Institutional vs. Individual Approaches to A.I. Adoption

Financial institutions (FIs) typically take a “trust but verify” approach to A.I. implementation, establishing robust oversight mechanisms before deploying solutions. Meanwhile, individual adoption tends to move faster with greater flexibility. The journey typically begins with innovation and value proposition development before moving toward minimum viable products.

When A.I. implementation falters, the conversation pivots to accountability and coordination within organizations. Human oversight remains essential for managing A.I. systems and mitigating risks. Success requires ongoing development of enterprise-wide A.I. strategies with collaboration across technology and management teams. Without structured processes and clearly defined roles, even promising AI initiatives can fail to deliver expected results.

Performance Attribution and Analytics: The Data Challenge

For A.I. to effectively assist with performance attribution and analytics, high-quality data and interactive capabilities are non-negotiable. Static A.I. models were deemed insufficient for scaling operations, highlighting the critical need for adaptable systems that can evolve with market conditions and client requirements.

Practical use cases included A.I.-assisted coding to bridge technical gaps and improved communication through automated drafting of client correspondence. These use cases demonstrate how A.I. can enhance both operational efficiency and client experience when properly implemented.

Industry Insights: The Reality of AI Implementation

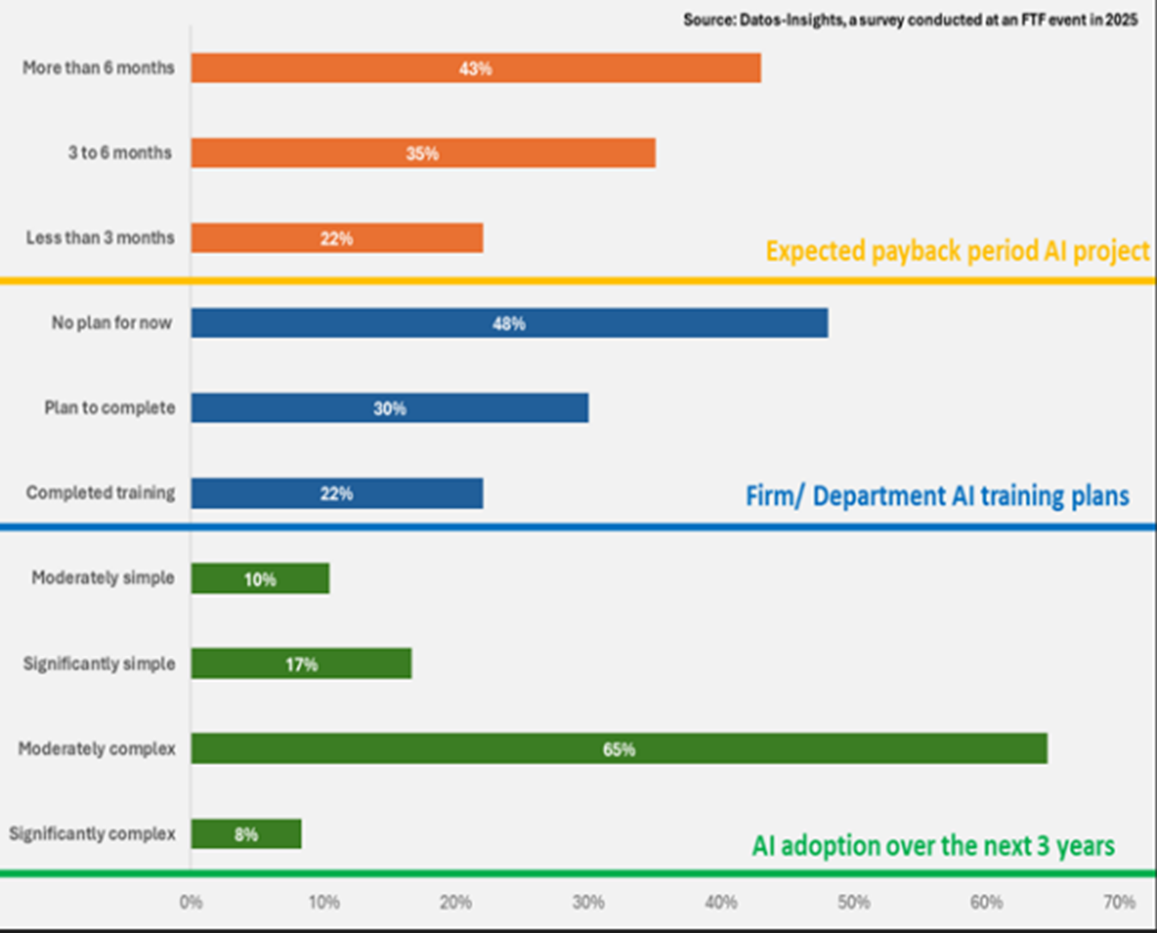

A poll conducted at the FTF PMCR event revealed thought-provoking insights into how organizations perceive the anticipated payback period from AI projects, training efforts, and AI adoption over three years.

The expectations surrounding the payback period for A.I. investments reflect cautious optimism, with most firms anticipating returns beyond six months. A significant proportion of firms have yet to plan comprehensive training strategies, highlighting gaps in preparedness. Additionally, most participants predict moderate complexity in adopting A.I.

These findings shed light on the diverse perspectives shaping the AI landscape, particularly in capital markets, and offer a glimpse into the opportunities and hurdles that lie ahead.

Payback Period Expectations

The expectations surrounding the payback period for A.I. investments reflect cautious optimism. While 22 percent anticipate the payback period on an A.I. project within three months, showing optimism for quick gains, 30 percent expect returns within three to six months.

However, almost half of the participants (48 percent) predict a payback period of more than six months, demonstrating a cautious and measured perspective on the realization of financial benefits from A.I. investments. For buy-side firms, the payback period can be influenced by the effectiveness of A.I. in generating alpha, improving operational efficiency, and reducing costs, emphasizing the importance of strategic planning.

A.I. Training Readiness

The results highlight varying levels of engagement and preparedness for A.I. training across organizations, with 48 percent confirming that they have “No plan for now” regarding A.I.-based training, showcasing a lack of immediate focus on this area. Meanwhile, 30 percent indicated that A.I. training is underway, and 22 percent reported completing such training.

In performance attribution and client reporting, precision and expertise are crucial. A.I. training becomes essential to help employees leverage A.I. tools for risk assessment, trade execution, and client reporting. Buy-side firms must prioritize training to equip their analysts and portfolio managers with AI-driven insights, allowing them to make data-backed decisions in real time.

Anticipated Implementation Complexity

Most participants (73 percent) predict A.I. adoption to be moderately to significantly complex. This realistic assessment reflects the challenges financial firms face in navigating regulatory requirements, managing data-intensive processes, and ensuring seamless integration across front, middle, and back-office operations. For buy-side firms, A.I. offers a significant opportunity to enhance portfolio management, optimize trading strategies, and automate repetitive tasks, making adoption both promising and challenging.

Taking Action Now

The journey toward A.I. adoption is marked by both opportunities and challenges. Organizations largely anticipate moderate complexity in integrating A.I., reflecting a pragmatic outlook on the process. However, gaps in A.I. training plans suggest a need for greater focus on upskilling teams to harness the full potential of A.I.

While expectations around payback periods vary, cautious optimism demonstrates confidence in A.I.’s long-term value for these sectors. As businesses navigate these dynamics, a balanced approach to strategy, training, and investment will be crucial to realizing the transformative benefits of A.I.

Need a Reprint?

Leave a Reply